georgia estate tax laws

TITLE 45 - PUBLIC OFFICERS AND EMPLOYEES. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

Georgia Retirement Tax Friendliness Smartasset

Georgia inheritance law governs who is considered an heir or how assets are passed down when someone dies.

. Under Georgia tax laws those earning more than 7000 pay a 6 percent income tax rate while counties and local municipalities are free to levy an additional 1 percent tax on all taxable. Current as of April 14 2021 Updated by FindLaw Staff. Unless otherwise provided by law all real and personal property of nonresidents shall be returned for taxation to the tax commissioner or tax receiver of the county where the property is.

Ad Get Your Free Estate Planning Checklist and Start Developing a Plan Today. TITLE 46 - PUBLIC UTILITIES AND PUBLIC TRANSPORTATION. Property Tax Homestead Exemptions.

This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at death and for. Georgia Code Title 53. The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws.

Taxpayers have 60 days from the date of billing to pay their property taxes. Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000. The bill has two main thrusts.

County Property Tax Facts. Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. Sales Use Taxes Fees Excise Taxes.

Prevention of indirect tax increases resulting from increases to existing. Recording Transfer Taxes. 48-5-7 Property is assessed at the county level by the Board of Tax.

Wills Trusts and Administration of Estates. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. TITLE 43 - PROFESSIONS AND BUSINESSES.

Get the Info You Need to Learn How to Create a Trust Fund. The law provides that property tax returns are due to be filed with the. If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000--.

A QA guide to Georgia laws on estate taxation of transfers at death. Wills Trusts and Administration of Estates. Even though there is no estate tax assessment federal state taxes still exist.

TITLE 44 - PROPERTY. Most states including Georgia have homestead protection laws allowing. Property taxes are normally due December 20 in most counties but some counties may have a different due date.

Learn everything you need to know here. Property Tax Returns and Payment. Fortunately Georgia is one of 38 states that does not assess estate tax against individuals.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XM7O6ATEK5IHJA7K3M26Y63NAI.jpg)

Georgia Anti Abortion Law Allows Tax Deductions For Fetuses Reuters

State Corporate Income Tax Rates And Brackets Tax Foundation

Estate And Gift Tax Planning Wolters Kluwer

Create A Living Trust In Georgia Legalzoom

Georgia Retirement Tax Friendliness Smartasset

Pin By Phoebe Jules On Homes Mansions Mansions Luxury Mansions Homes

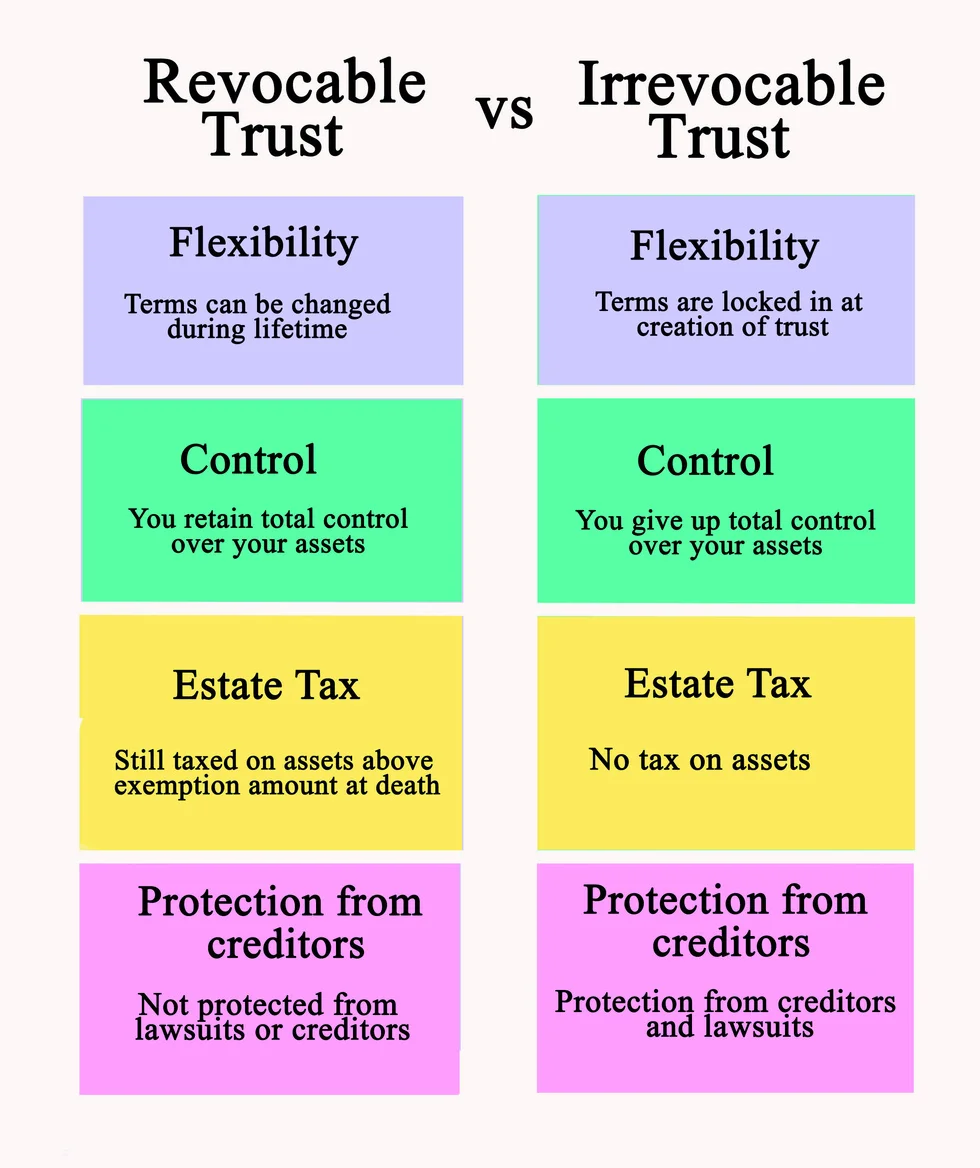

Marietta Trust Lawyer What S The Difference Between A Revocable Trust And An Irrevocable Trust Georgia Estate Plan Worrall Law Llc

Where Not To Die In 2022 The Greediest Death Tax States

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Inheritance Laws What You Should Know Smartasset

Irs Announces Higher Estate And Gift Tax Limits For 2020

Eight Things You Need To Know About The Death Tax Before You Die

Georgia Retirement Tax Friendliness Smartasset

Transfer On Death Tax Implications Findlaw

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Income Tax Cut Reform Details Analysis Tax Foundation

The Backforty Newsletter Of Land Conservation Law May June Etsy Estate Planning Conservation Land Trust

Georgia Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities